Hi friends,

did you know that the government, through the Minister of Finance who is in charge of taxation, has issued PMK 61 to provide clarity to taxpayers in implementing the tax collection scheme.

What are the contents and provisions in PMK 61? Let’s read in full in this post.

In the spirit of creating more legal certainty, fairness and equality for the taxpayers, as well as adjusting to some changes in the prevailing laws and regulations, the Ministry of Finance recently issued guidelines on the implementation of tax collection. It is regulated under Ministry of Finance Regulation No. 61 of 2023 (PMK 61). The regulation is valid as of 12 June 2023. As reflected in the title, this regulation provides guidelines for tax officials in implementing tax collection. This publication will briefly discuss the key points of the regulation.

Collectible Debt

The tax debt that is referred to in the PMK 61 are:

- Income tax

- Value-added tax

- Sales tax on luxury goods

- Sales tax

- Stamp duty

- Land and building tax

- Carbon tax

Note: The guidelines on the PMK would be applicable if the taxpayers still have not paid the tax payment that has been due after the end of the payment deadline.

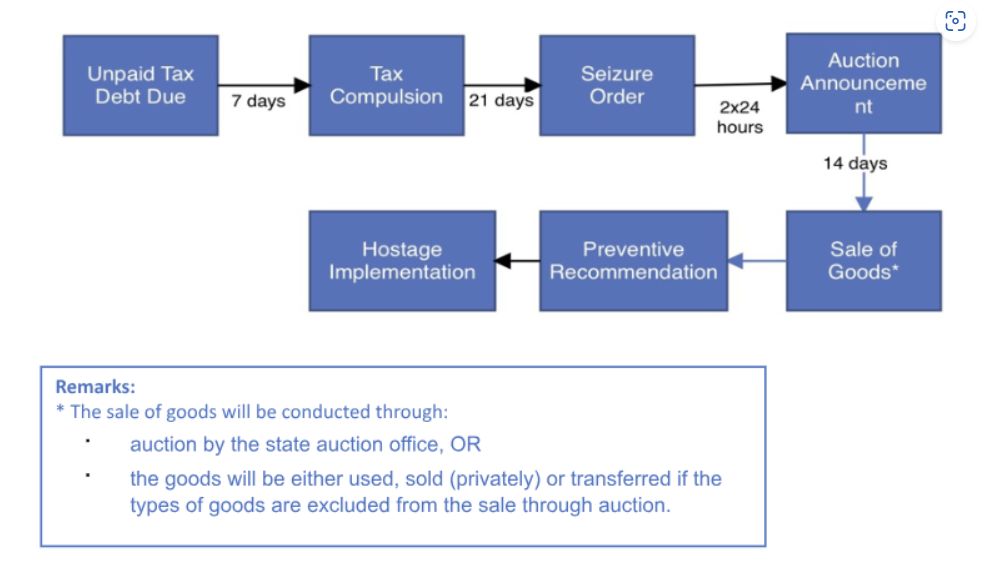

Tax Collection Actions

Tax collection action that are reguled under the PMK 61 are:

- Issue of warning letters

- Issuance of immediate and tax collection order

- Issuance and notification of tax compulsion

- Seizure

- Sale of the seized goods

Note: The object of the seizure includes (i) goods owned by the taxpayers, and (ii) goods owned by husband/wife/children who are still dependent on the taxpayers unless there is a nuptial agreement.

- Sale of the seized goods

Note: Certain goods are excluded from the sale through auction, among others (i) money and securities (savings, time deposits, insurance, obligations, shares, receivables, capital participation in other companies).

- Preventive recommendation, or

- Hostage implementation

Procedures

Subject of the Tax Collection

The subject of the tax collection is the taxpayers who have not paid the tax payment that has been due after the end of the payment deadline. This includes (a) individual taxpayers and (b) corporate taxpayers.

- Individual Taxpayer

The taxpayer also includes (i) the wife of the taxpayers (if the tax obligations of the husband and wife are combined, (ii) heirs of the deceased taxpayers, (iii) guardians of under-aged children, or guardians of persons under guardianship.

- Corporate Taxpayer

The corporate taxpayer also includes the managers (administrators) of the company who are responsible for the tax debt and tax collection fee. PMK 61 further describes managers of a limited liability company as (i) board of directors, (ii) board of commissioners, (iii) authorized person to determine policy or make decisions over the company, (iv) shareholders – this also includes indirect majority shareholders or controllers. In addition to the elaboration of managers for limited liability companies, PMK 61 also provides examples of managers for other legal entities.

Coorperation with Partnered Jurisdiction

As supported under Law No. 7 of 2021 on Harmonization of Tax Law (HPP Law), PMK 61 also encourages cooperation between the Ministry of Finance and partnered jurisdictions or partnered countries to assist with tax collection. The cooperation will be carried out based on international agreement between the countries reciprocally, among others international agreements on (a) approval on prevention of double taxation, (b) convention on co-administrative assistance in tax, or (c) other bilateral or multilateral international agreements.

Statutory Period

The right of the tax officials to carry out tax collection (including interests, penalties, and tax collection fees) would expire after ten years of the due tax payment. The statutory period for tax collection will be suspended if (a) a warning letter or (b) there is an acknowledgment of the tax debt by the taxpayers (either directly or indirectly).

Conclusion

After the issuance of the HPP Law, the government, especially through the Minister of Finance who supervises the tax division, has issued several regulations to amend the prevailing regulations – to comply with the requirements under the HPP Law. This also includes the issuance of PMK 61 which provides more clarity and guidance to the taxpayers on imposing the tax collection scheme. This way, hopefully, there will be certain standards for the implementation of tax collection in Indonesia which can minimize corruption practices and provide more legal certainty for taxpayers.

If you need Accounting and Tax Services, visit our page http://kjasigitwijanarko.co.id or hub. 082336833231 (WhatsApp)

Leave a Reply